By Denis Jjuuko

Somebody told me that to survive in Kampala, you need to learn a few tricks. One of them that caught my attention is on lending money to friends and relatives. Like almost everyone in Kampala, he receives several requests. A relative who needs to borrow to pay school fees, buy food for their family, pay rent, take a sick child or parent to hospital or enjoy a night out in the bars with the most dazzling lights.

When he had just started working, he told me, he almost realized that he didn’t have any money left after he had met most of the borrowing requisitions sent his way. Years later, he came to realize that those who borrowed never paid back. In fact, some even returned to borrow more. He had to be ingenious if he was to survive in the city.

He devised a method of only lending without expecting anything in return. So, if a friend, co-worker or relative called to borrow, he would only lend what would not affect him significantly. If somebody called to borrow say Shs200,000, he would offer to lend them Shs50,000. He never expected this money to be paid back. He never calls them to remind them of their obligations. If anyone paid back, he considered it a bonus.

This method also worked as a deterrent. The majority of those who borrowed never came back to borrow again. Those who did, he would remind them that they hadn’t paid back what they had borrowed earlier. Many would pretend to be ashamed but at least he knew that person would never disturb him again. He says this model has worked for him and saved him the anguish of expecting money from people who had no intentions of paying back.

I was reminded of this last week when a study funded by the central bank indicated that the majority of adult Ugandans or 17.2 million people out of 24.6 million survive by borrowing. The snippets from this study have made national headlines in some of the daily newspapers. For a country to have 70% of its adult population surviving on borrowing should be worrying.

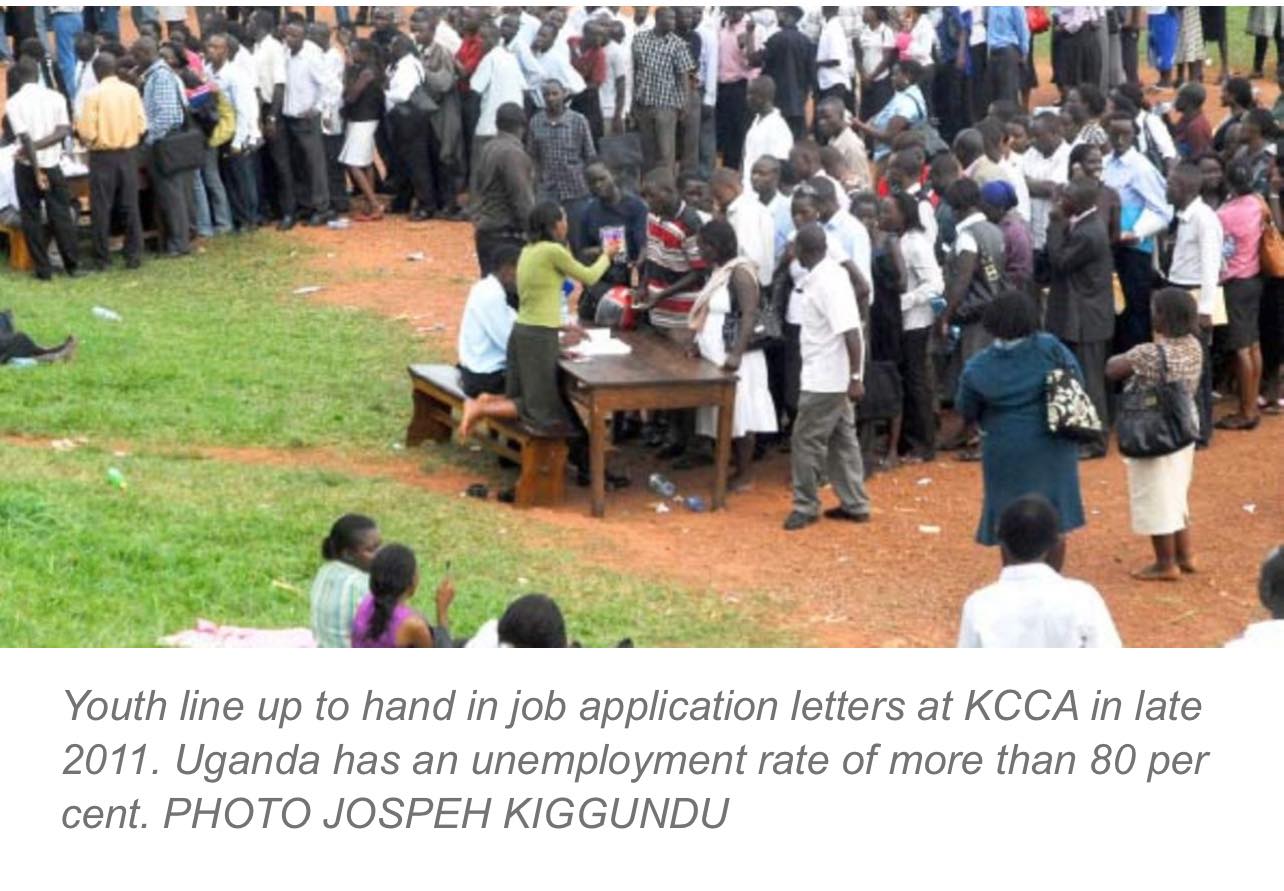

Uganda being such a young population, it means that most of these people are unemployed or earn so little to “afford life.” And when they retire or unable to work, they won’t have any pension to depend on. Many adult Ugandans who aren’t borrowing have become beggars. Parents begging their children. Couples begging their partners. Parents begging their sons and sometimes daughters in law.

When we talk about borrowing, it gives a connotation that at one stage, money will be paid back by the borrower. Although it wasn’t clear in the report who lends these Ugandans money, many borrow from friends and relatives as the case of my friend. Money that is usually not paid back.

To be honest, many of the borrowers have genuine problems largely based on our lack of good public schools and health facilities. Many are dehumanized to borrow and if they had a chance to find employment, they would diligently work. That is why Entebbe airport departure lounges are full of young people going abroad to seek employment. Had they been lazy as some people (especially politicians) allege, they wouldn’t be frequenting the Arabian deserts.

Since the money borrowed is largely never paid back, the lender is denied an opportunity to invest it in worthwhile ventures which could provide a return on investment. That is why one of the reasons people end up without sustainable pension. They spend a lot of their resources while working to look after other adults, thereby playing the role of a government without the resources of a government. When time for retirement comes, they have nothing sustainable to rely on. The borrowing cycle continues for generations thereby entrenching household poverty.

Some people call this “black tax” — money black people pay to sustain their extended family and a host of friends. It also fuels corruption. Few people are going to do the right thing when they have a sick mother at home and are struggling with hospital bills or when the children are home instead of school.

Government needs to find a way for the majority of people to find sustainable jobs, provide at least affordable public health and education services so that they don’t depending on borrowing from people who also don’t have much.

That would require the reduction on the largesse of government officials on stuff that provide no real value, provide incentives to local businesses to thrive instead of employing methods that lead to their closure while at the same time attracting the elusive foreign direct investment to spur economic growth.

The writer is a communication and visibility consultant. djjuuko@gmail.com