By Denis Jjuuko

Almost a trillion shillings is lying idle in dormant bank accounts, the Bank of Uganda said at a presser recently. And if this money is not claimed in 10 years, it would be taken by the government. You can call it the Idle Money in Bank Accounts Tax.

If they lend this money to themselves before they take it at just 10% per a year (net of taxes), they would have another trillion in 10 years.

How do people get to have money in dormant bank accounts? Bank of Uganda and ministry of finance officials didn’t say. But maybe people die and the next of kin don’t how to process this money or some are too liquid that they leave money lying idle in dormant bank accounts for years.

The problem though is that this money is bad for the economy. It makes government lazy, earning money they have not worked for, which means they may not care how it is spent. If you earn free money, you have a license to be wasteful.

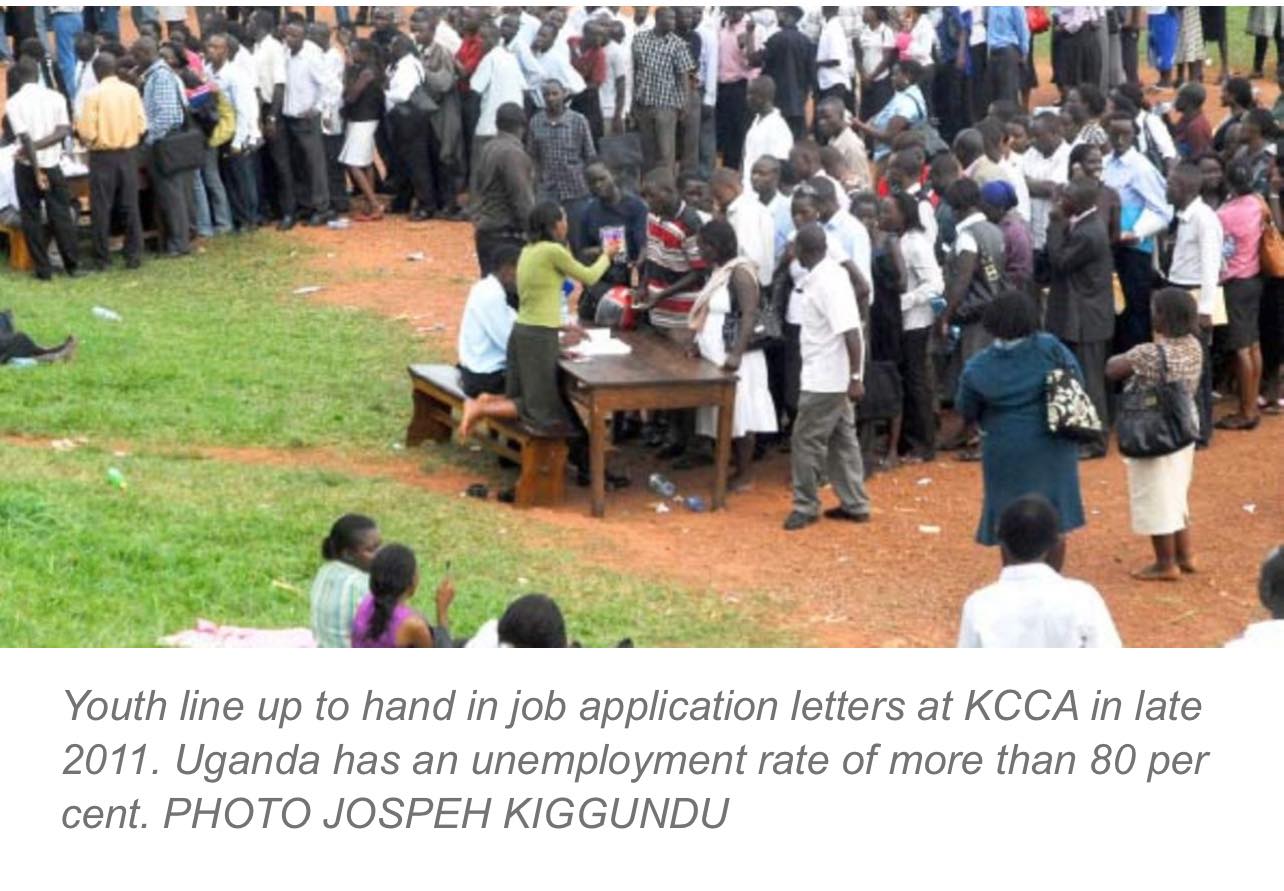

If a trillion shillings had been spent or invested, there would have been some improvements in the economy. A trillion shillings can create many small jobs and sustain many others.

But how can we avoid a scenario where money remains idle in bank and now mobile money accounts to the extent that the government takes it away. One way is to ensure that at least your next of kin knows the banks and mobile money where you invest. If you die suddenly, they would at least claim it and use it. The other is to have a will where bank accounts are listed and money allocated to people who can utilize it upon your death.

However, one way we can avoid having idle money is by investing it. Many studies tell us to save and it is important and may be that is one of the ways accounts become dormant. Money should be invested to make more money. I may be wrong but I believe that invested money doesn’t end up in dormant accounts.

How can we invest money? Many times, we think that to invest you need a lot of money. It is sometimes small amounts that can lead to significant investments. Somebody I know wanted to buy land so she can join the real estate sector. She wanted at least an acre within 20km of the Kampala central business district. She didn’t have even a quarter of the value of what she wanted but she decided to go ahead and look for sellers that would accept her payment plan. After many months of searching, she found somebody who agreed to her payment plan.

She made a deposit and started putting whatever little money she got into the mobile money account of the seller. Whenever the seller was hard up, he would call sometimes for as little as Shs100,000. If kids were going to school, the seller would call. If he lost somebody and wanted to go for burial, he would ask for money.

She just kept a ledger of the transactions. Before not too long, she had paid off the guy and she received her land title. She got a surveyor to subdivide the land into eight plots, which she now sold off at a premium. Last I heard from her, she was now dealing in much bigger sizes.

Accumulating capital is through investment and not necessarily through savings. And in a country where raising capital is a challenge due to the high cost of money, starting small is always the easiest way to do so. Finding somebody who can accept your payment terms for something so huge is one way to do it.

Idle money if not left in dormant bank accounts, it could easily be spent on non-essentials. With an economy that contracted due to Covid-19, there are always more people asking for money than ever. People you hardly talk to will text you for money and if you have it, you may feel guilty for not helping them. If you have credit with your suppliers, you will think twice before helping every undeserving person who asks.

The other key thing is not to be secretive about the projects that you are involved in with your family and close friends. A spouse won’t expect you to offer endless dinners in 5-star restaurants when they know that the guys setting up your factory are demanding payment for the steel beams and trusses they supplied last week. They will understand when you say you are broke.

The writer is a communication and visibility consultant. djjuuko@gmail.com