By Denis Jjuuko

Some old people in Uganda receive some Shs25,000 a month from the government to enable them to “afford life.” The people who are involved in this activity claim that the elderly on this program look forward to this money as it enables them pay for some household needs.

Most people would like and even pray every single day to live long lives. I don’t know though how many would love to survive on this Shs25,000 (US$6.5) a month. Nevertheless, one is better than zero.

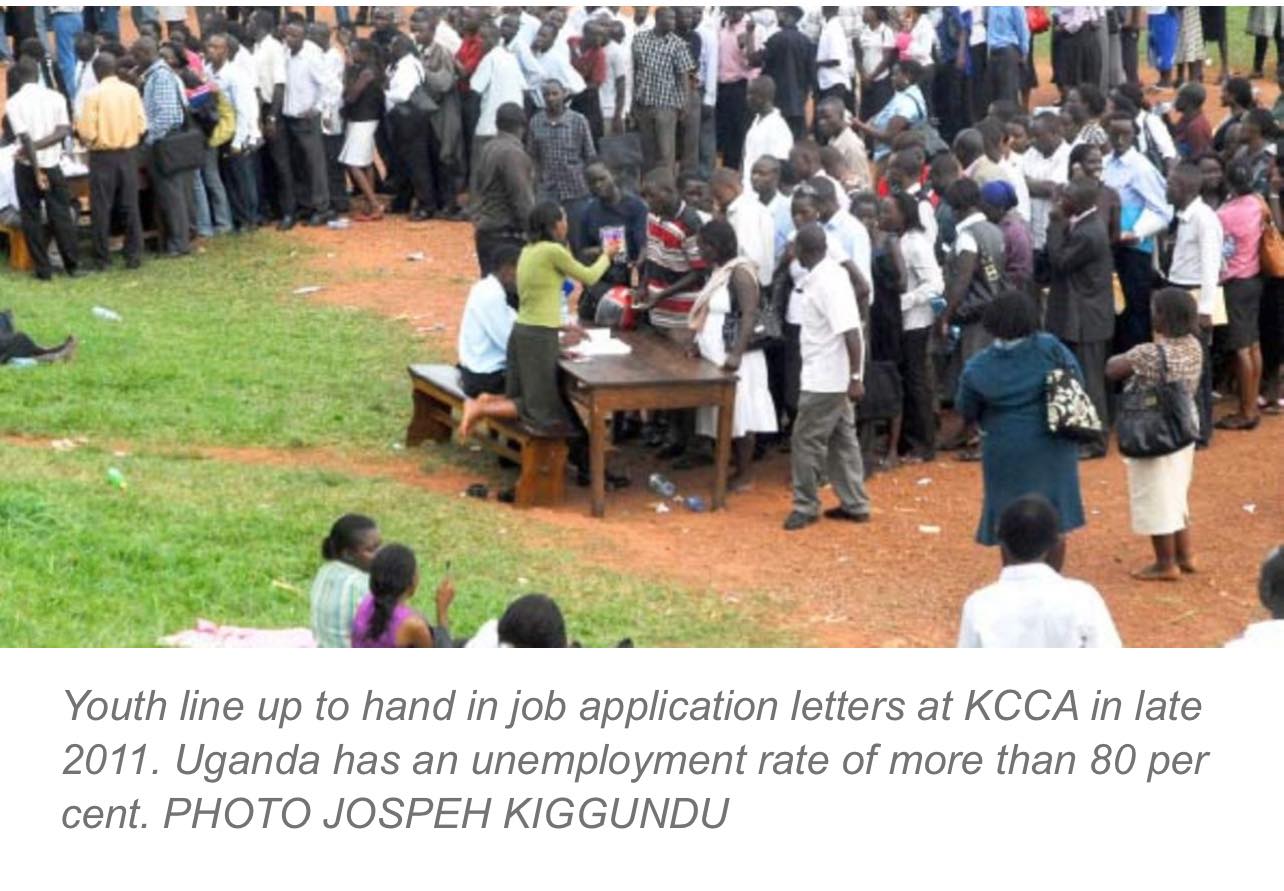

Uganda’s workforce stands at more than 18 million people today. The majority of these people will in about 30 years retire from their jobs either because they have reached their age for retirement or too old to hustle. Most of these people today are unsalaried and will remain so for all their working lives as they work in the so-called informal sector.

Even though most of these people will not be able to kuyiriba (hustle), many will still be alive given the improvements in medical treatment technologies, availability of information and living generally better lifestyles. The challenge they will face will be consistent income.

For decades, many people banked on their children to look after them during retirement especially those that managed to pay school fees for these offspring. Although that may have worked in the past, it is one sure way of suffering as you wait for the benevolence of the children, who themselves may not have much or may prefer to spend their money elsewhere. We are increasingly becoming capitalistic. The social system that most people in Africa depended on is getting broken as the continent urbanizes.

And if millions of people retire or unable to work every year, the government cannot be able to pay those on regular pension (retired civil servants), those being retrenched from public service and the elderly. Even if they pay, the Shs25,000 a month is too little to enable anyone live a decent life.

Uganda isn’t the only country that has this problem. Africa is the youngest continent where the median age is 19 but with a working population of 788 million people. Like Uganda, the majority of these people will be retiring in 20-30 years. Again, like Uganda, the majority of these people (600 million) have no pension savings. When they retire, they will become destitute.

In Uganda, employers are supposed to contribute to NSSF for their workers but the reality is that many people in informal jobs can’t do this. We are known as the most entrepreneurial country in the world but the majority of these entrepreneurs are kuyiriba-ring such as hawking, being paid for work done or per a day etc. Just study those who claim to own online shops or the guy slashing your compound where he comes once a week during the rainy season and maybe once a month during the dry season. Who will pay his NSSF? They may be catered for in the law but the reality is different.

What needs to be done is to create systems that can enable people to save by seeing the benefits of it. Many people are increasingly becoming members of village saving schemes, saccos or investment clubs (building societies), and Nigiina (where people raise money for one person on a regular basis until every member has received their share) among others. But these are usually short term and not looking at pension 15 or 30 years later.

I recently attended the African Pension Supervisors Association (APSA) conference and as experts debated pathways to sustainable inclusive pension in Africa, I kept on thinking about mobile money and how it can revolutionarize pension in Africa.

Periodically, I receive some mobile money. Little amounts. Last month, I got Shs2,695 as interest payment. There about 40 million mobile money users in Uganda. There are two major mobile money companies in Uganda and they each pay out an average of Shs5 billion per a quarter to customers like me. That is Shs10 billion every three months. In a year, that is Shs40 billion on average.

Imagine if this money was instead of sending it directly to me, they opened a pension account for me linked to my National ID where it is saved and invested? Growing at a net income of about 12% annually, this pension scheme would bring in Shs4.8 billion in net profit in the first year. If you compound this for 15-30 years and telcos contributing every quarter, many people would be able to retire with something.

It can also be linked to the national health insurance scheme and allow each member to voluntarily contribute. It would require innovative incentives to work such as withdraws of a certain percentage every five years or funeral covers for parents, spouses or offspring.

The writer is a communication and visibility consultant. djjuuko@gmail.com